Current State

When an employee is terminated, the user needs to manually reset vacation balances.

When the balances are reset, the next payroll run includes a specific usage transaction, aka “cashout”, that pays-out the balance in Payroll.

Balance-cashout process is semi-manual and error prone.

Improvement

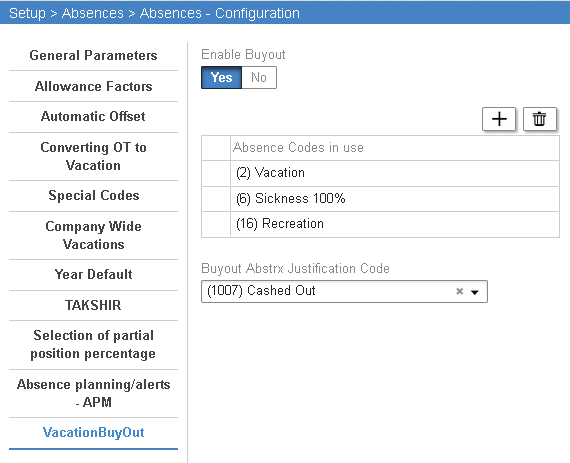

Added a new option in Absence configuration (ABCNF) for automatic cash-out upon employee termination.

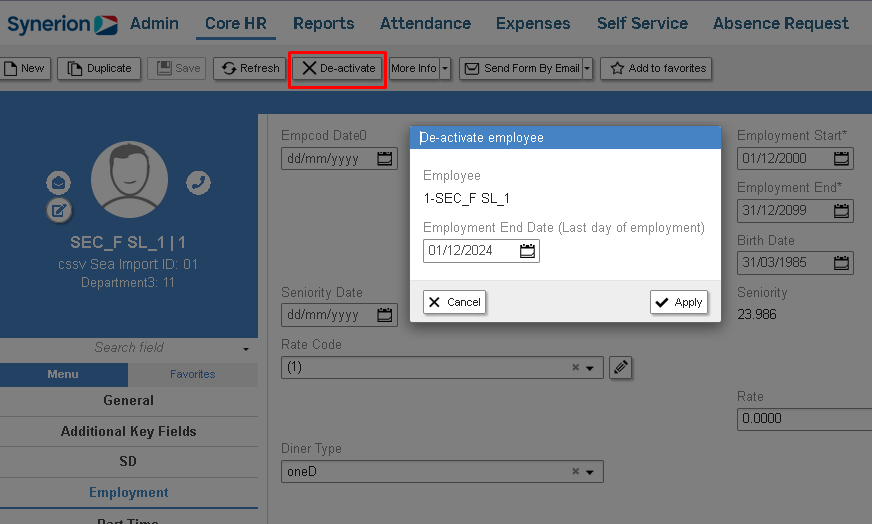

Employee termination can be done by using “De-activate” from CoreHR or by changing “Employment End” date from CoreHR / Master Adapter / API.

When enabled:

- Period calculation will create a specific ABSTRX record with the current balance value for the selected Absence codes, e.g., Paid Vacation.

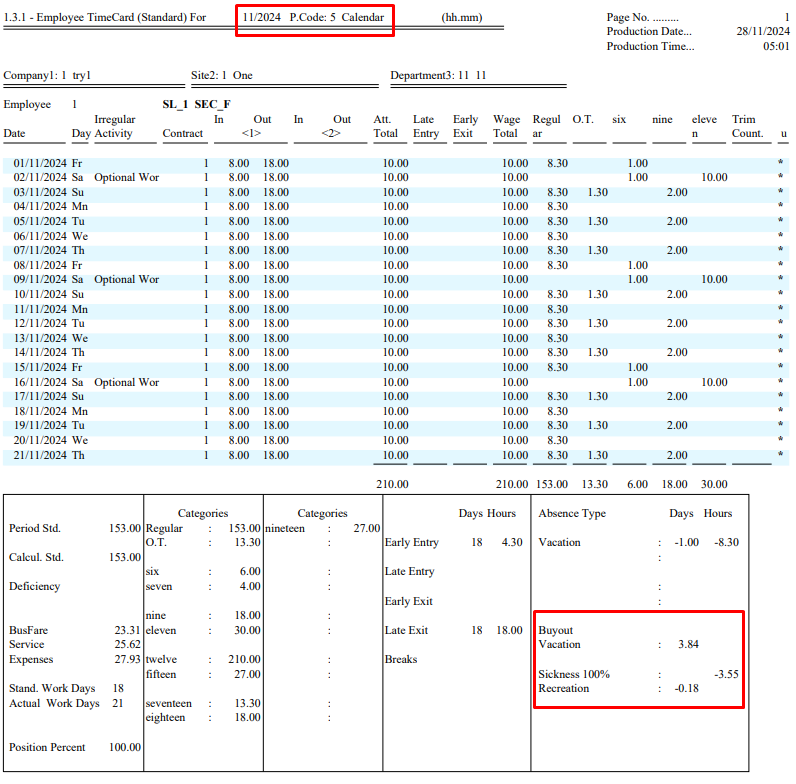

- Timecard reports will display the ABSTRX record.

Activation Settings

Absences – Configuration

Setup > Absences > Absences – Configuration

VacationBuyOut

New Parameters:

- Enable Buyout

(SYSEXT2.[CASH_OUT])

Values = Yes / No (Default)

When enabled, ABSTRX transaction will be generated upon employee termination.

At least one absence code should be selected from the list.

- Absence Codes in use

(SYSEXT2.[CASH_CODES])

Specify a list of absence codes that should be reset upon employee termination.

E.g., Paid Vacation and Personal Time Off.

Other absence codes will not be reset.

- Buyout Abstrx Justification Code

(SYSEXT2.[CASH_REASON])

Use a dedicated justification code for Buyout.

The Justification code will be used for payroll export.

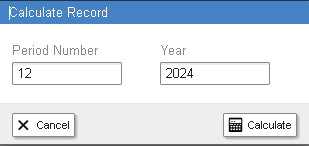

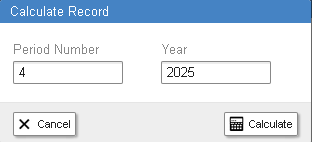

Period calculation

Period calculation will create the selected Buyout Abstrx Justification Code.

When the balance is > 0, the usage = Balance value (Positive) to be paid out in employee’s salary.

When the balance is < 0, the usage = Balance value (Negative) to be deducted from employee’s salary.

When the balance is = 0, no ABSTRX transaction will be created.

User Operation

Examples

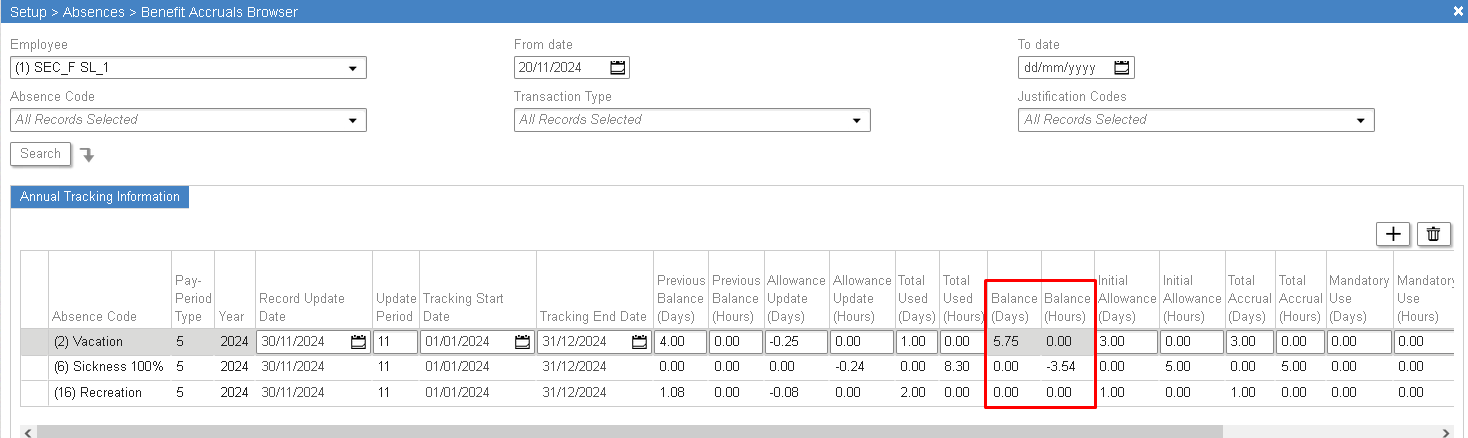

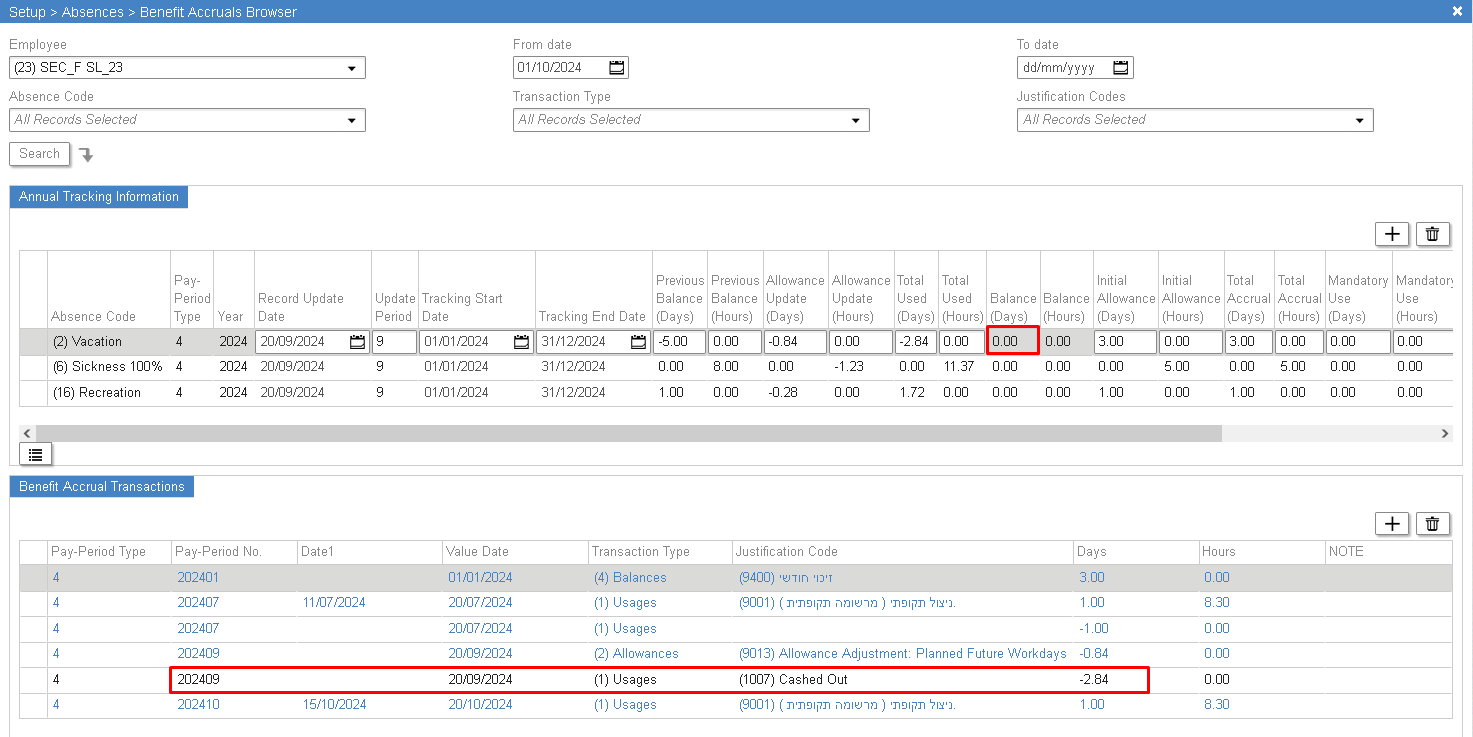

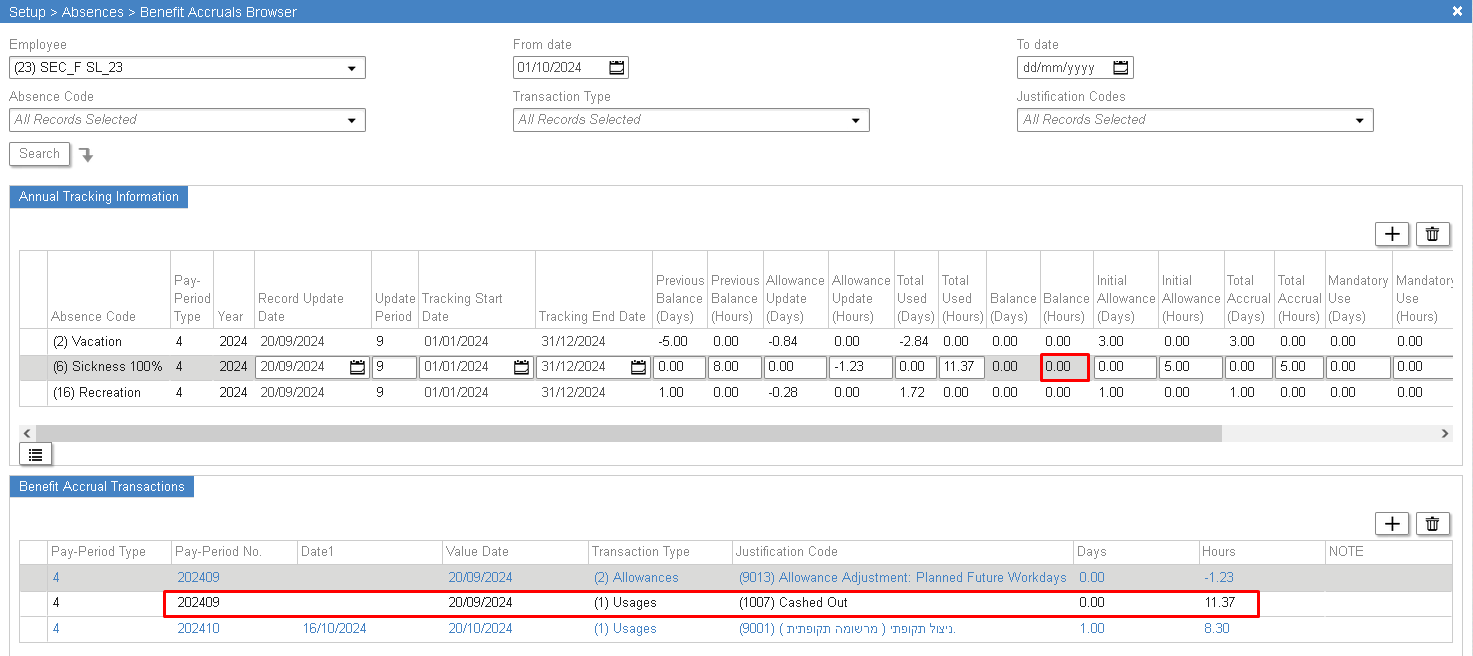

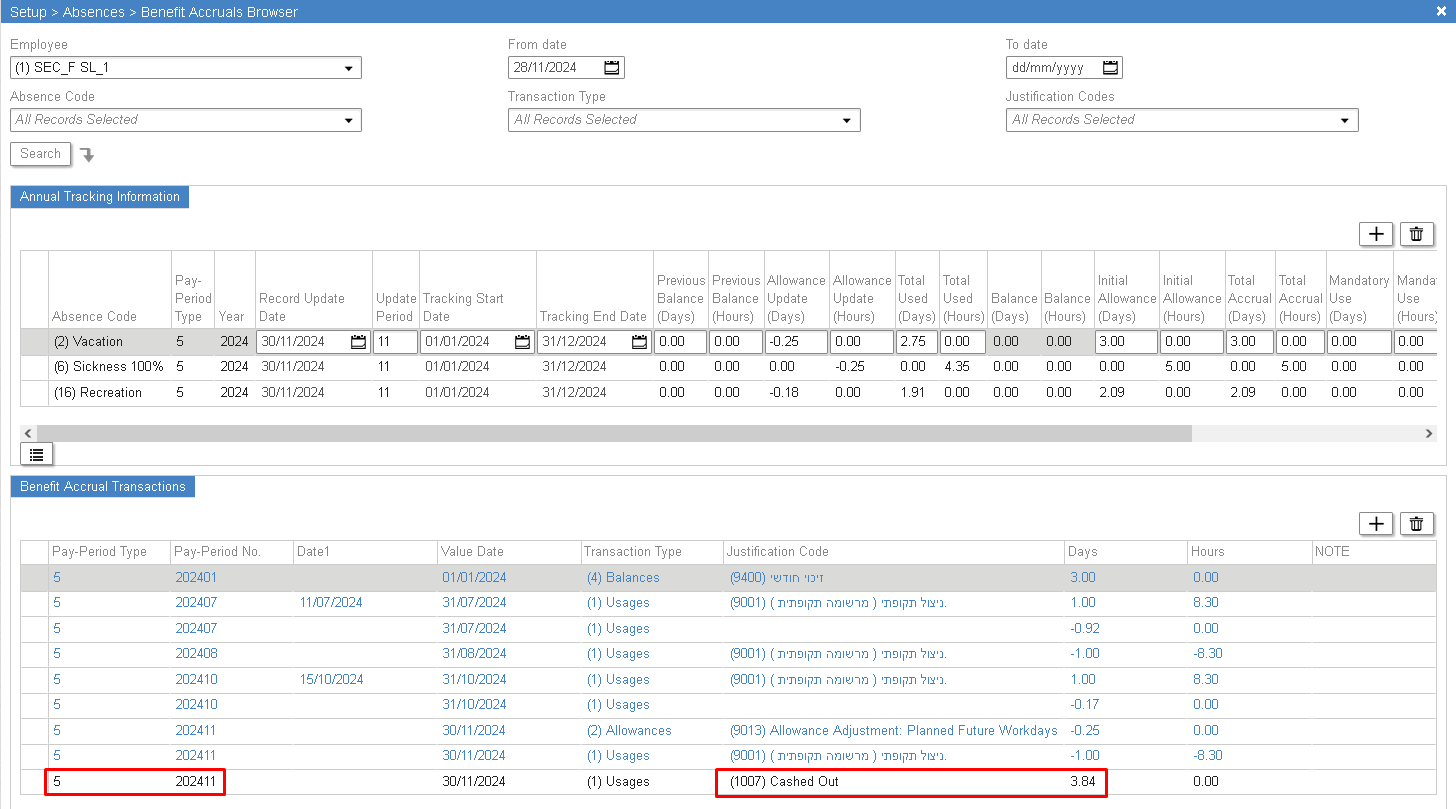

- Absence Codes in use = (2) Vacation in Days, (6) Sickness in Hours, (16) Recreation in Days

- Buyout Abstrx Justification Code = (1007) Cashed Out

Scenario | Result | |

1 | Future date – Next PP: | Transaction will be created |

2 | Future date > Future PP: | The transaction will be created when the future PP arrives |

3 | Current date: The user enters a termination date in the current PP | Transaction will be created |

4 | Previous PP date The user enters termination date on previous PP | The transaction will be created ONLY if the user |

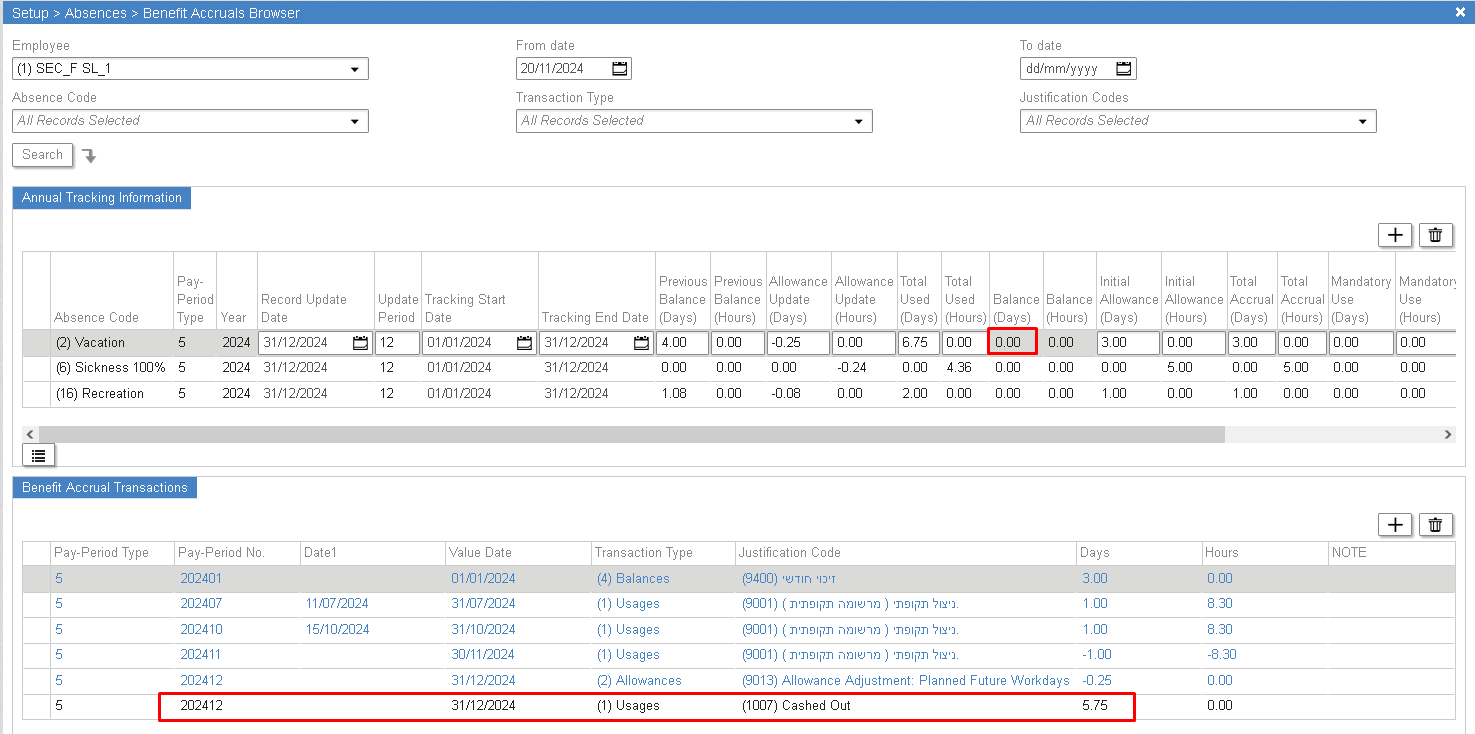

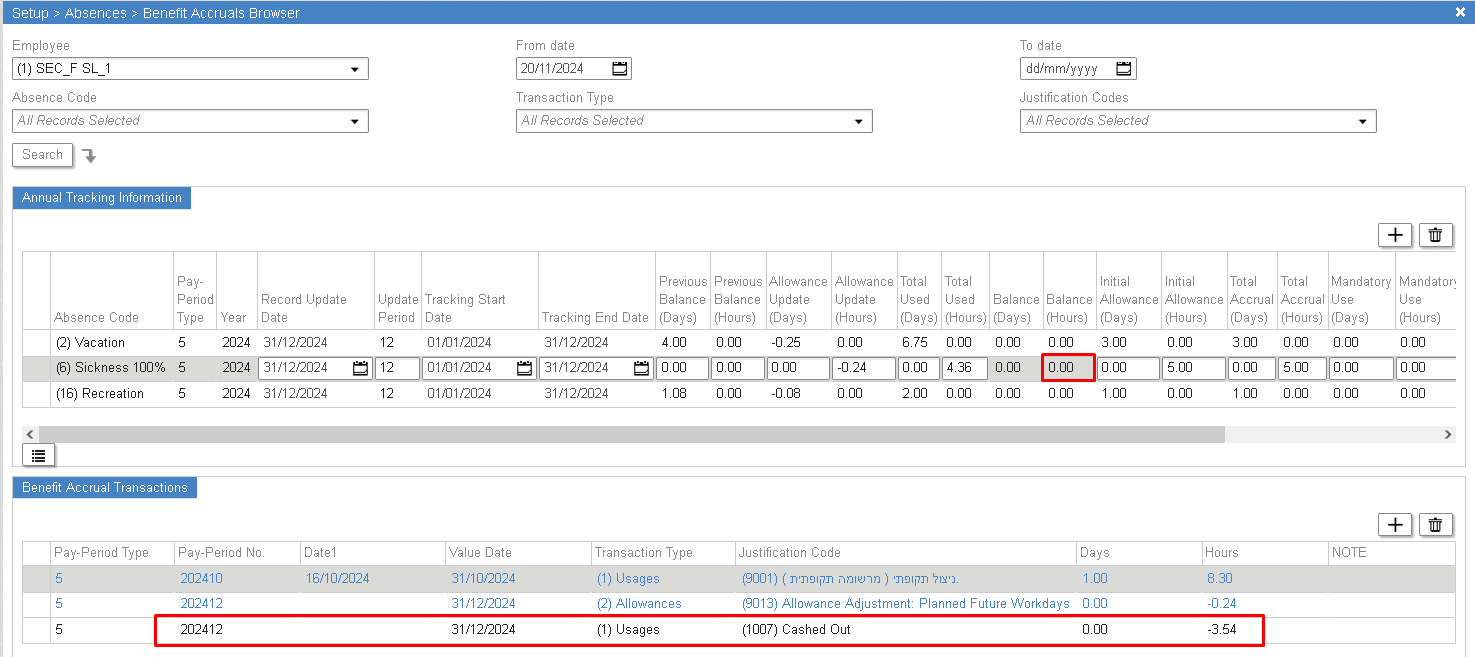

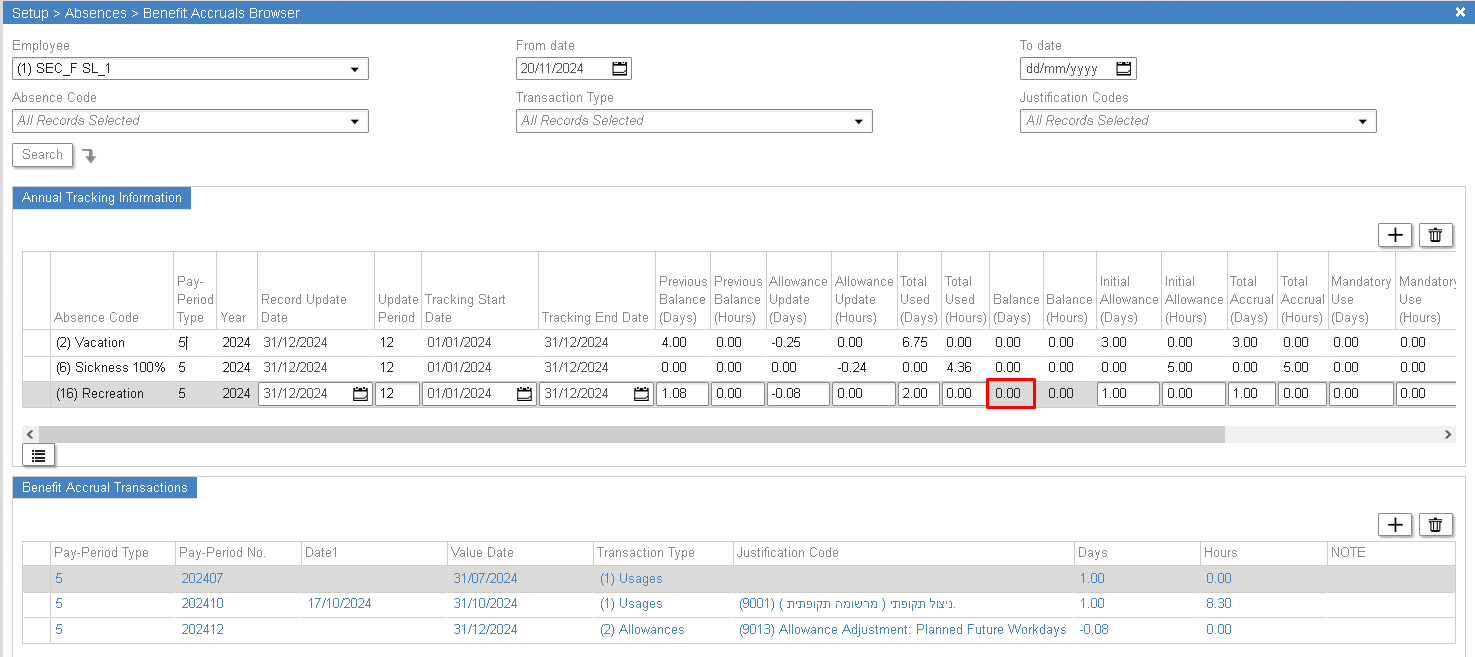

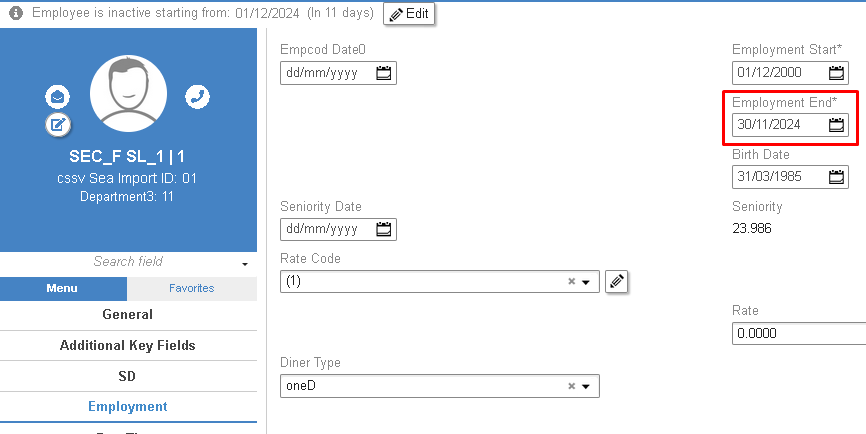

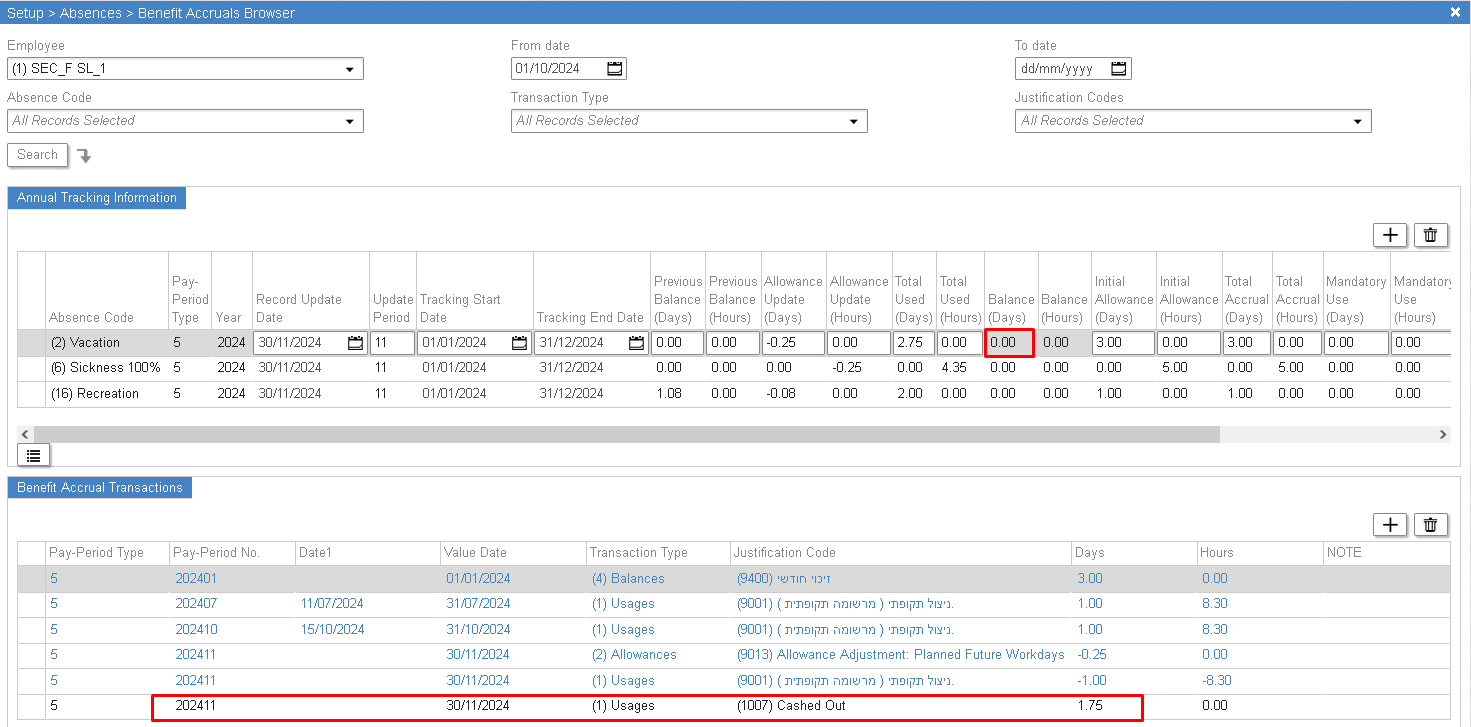

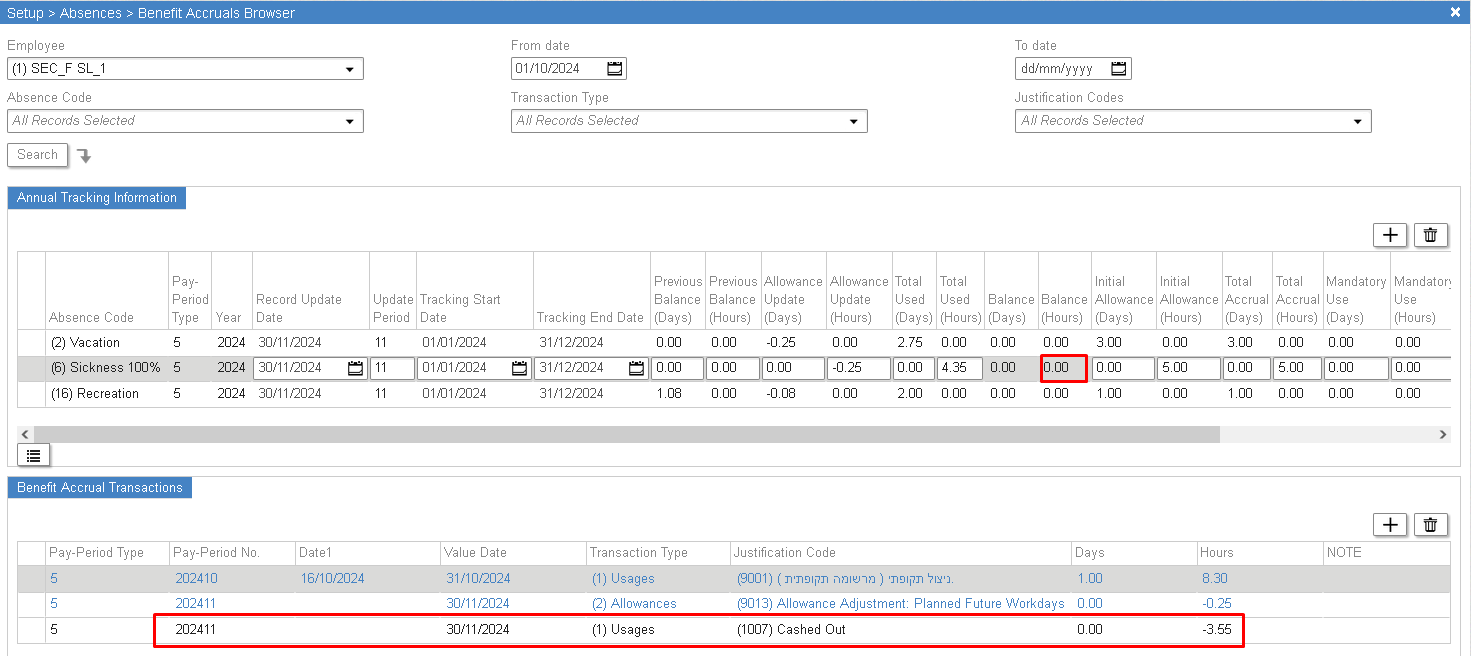

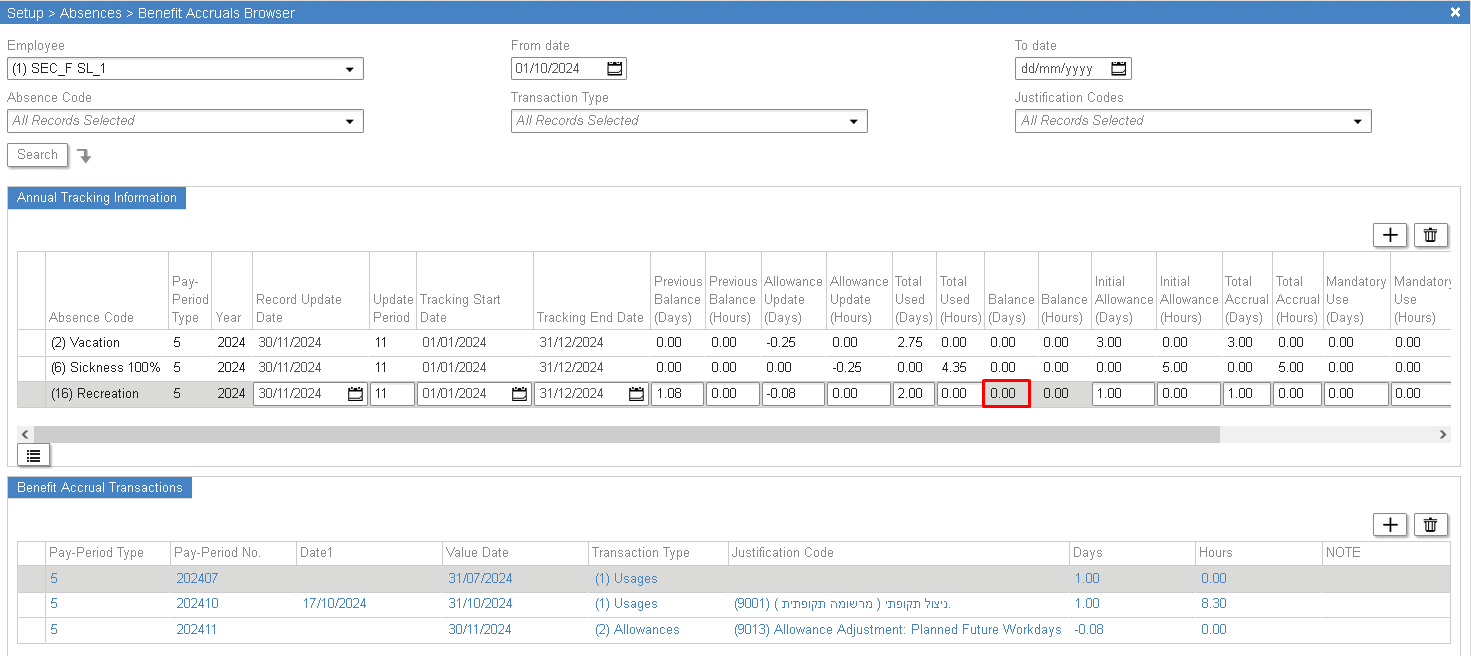

Scenario 1

Future date – Next PP

Current PP – November 2024

Balance for 30/11/2024:

(2) Vacation = 5.75 Days

(6) Sickness = (-3.54) Hours

(16) Recreation = 0 Days

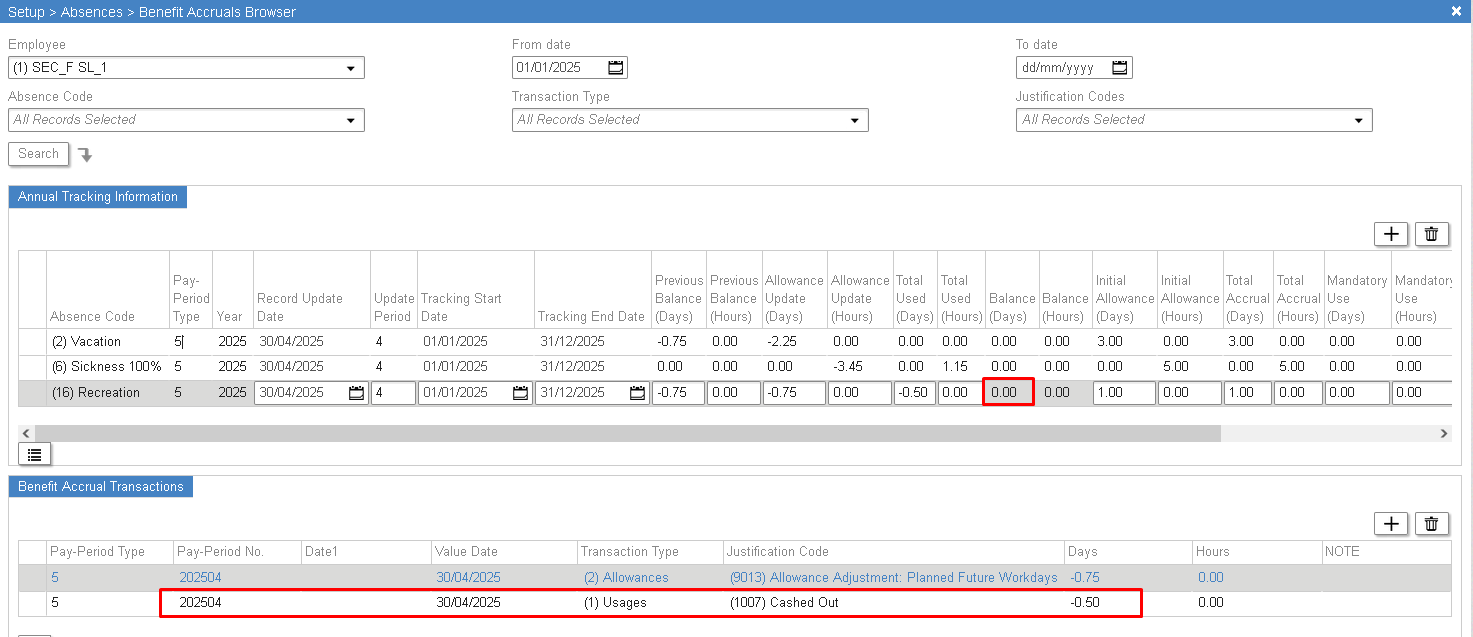

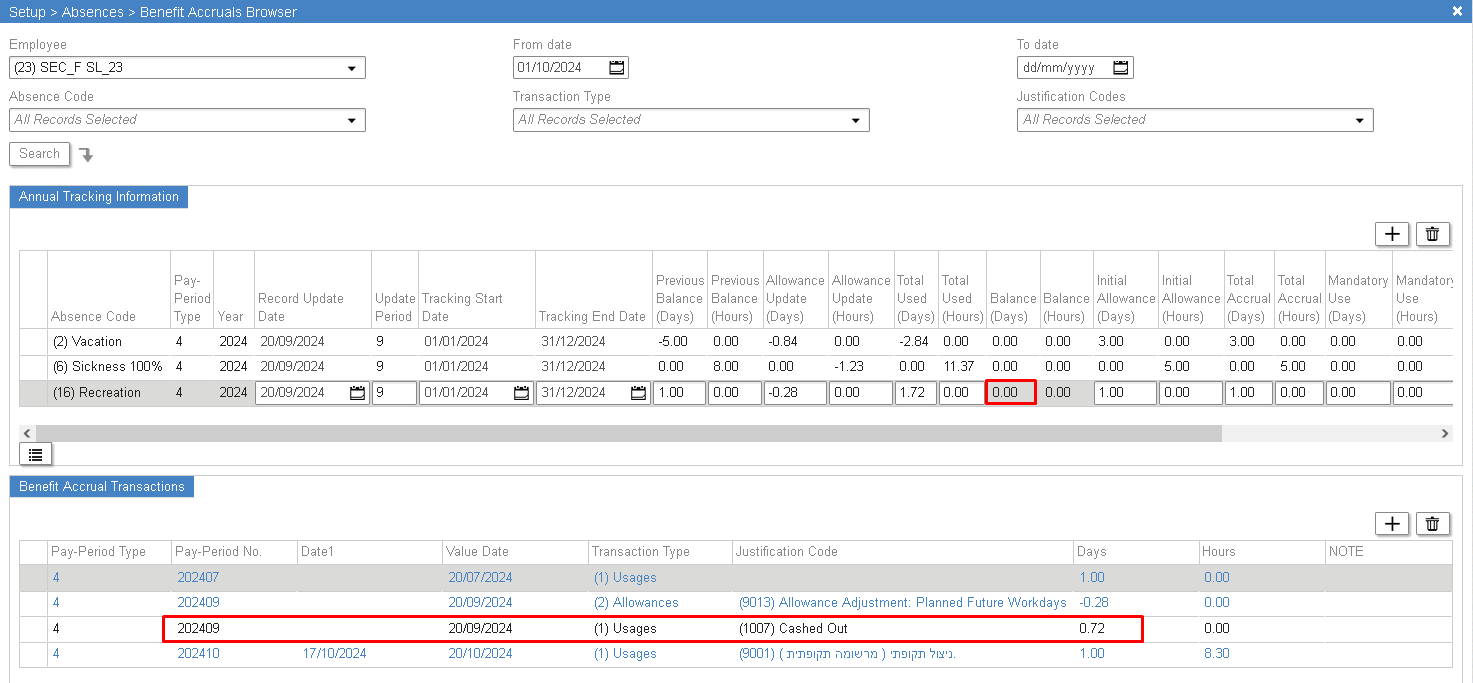

Setup > Absences > Benefit Accruals Browser

Employee 1 – Pay Period Type (5) Calendar

De-activation date = 01/12/2024

PP Summary for Next PP - December 2024

Balance for 31/12/2024:

(2) Vacation = 0 Days, Usage = 5.75 Days with Justification Code 1007

(6) Sickness = 0 Hours, Usage = (-3.54) Hours with Justification Code 1007

(16) Recreation = 0 Days, No Justification Code 1007

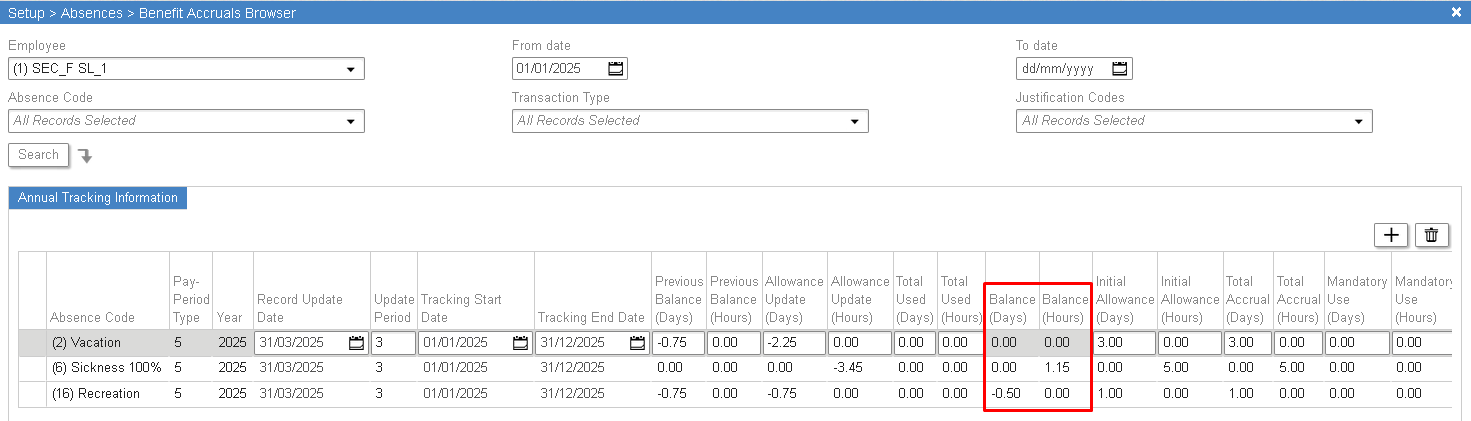

Scenario 2

Future date – Future PP

Current PP – November 2024

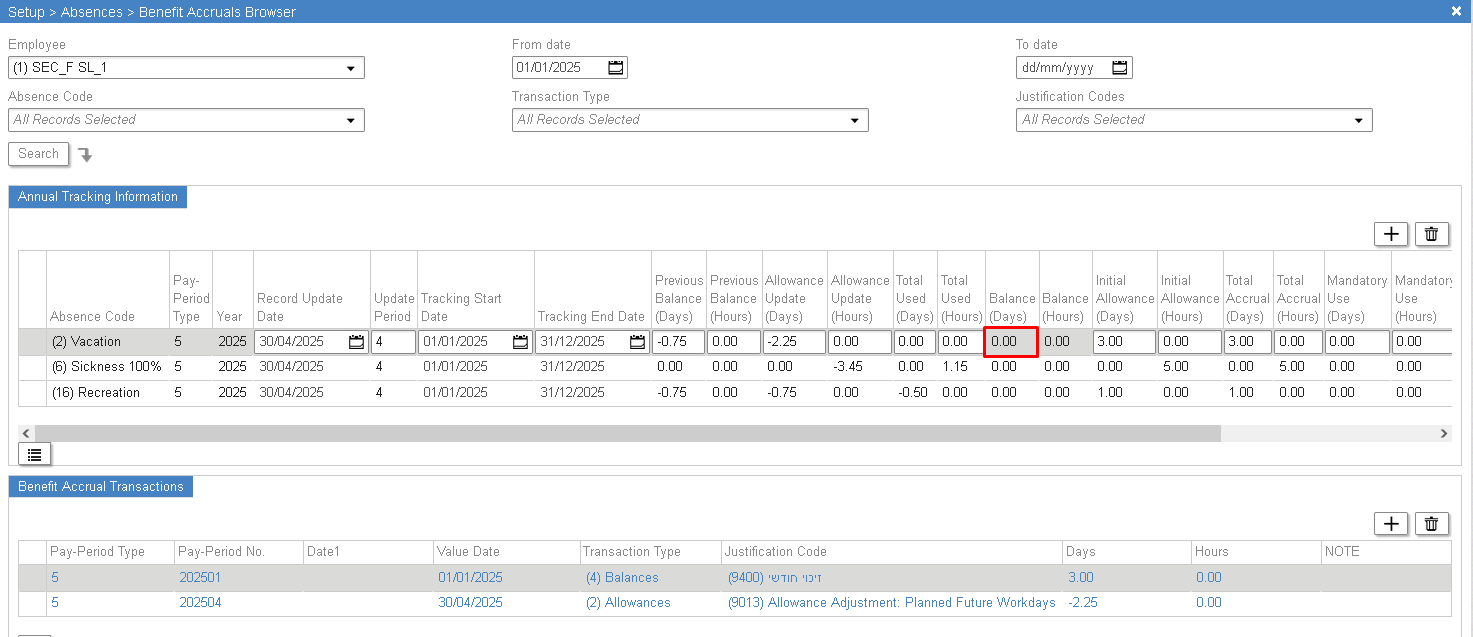

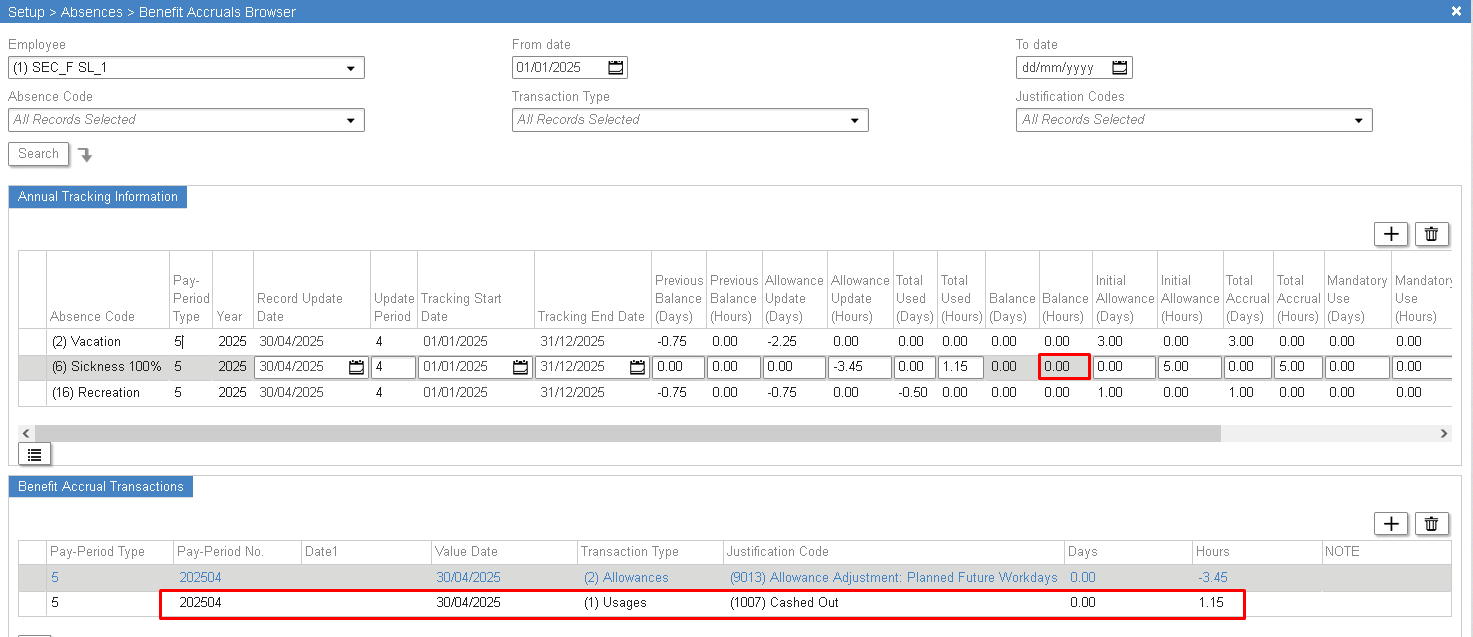

Balance for 31/03/2025:

(2) Vacation = 0 Days

(6) Sickness = 1.115 Hours

(16) Recreation = (-0.50) Days

Employee 1 – Pay Period Type (5) Calendar

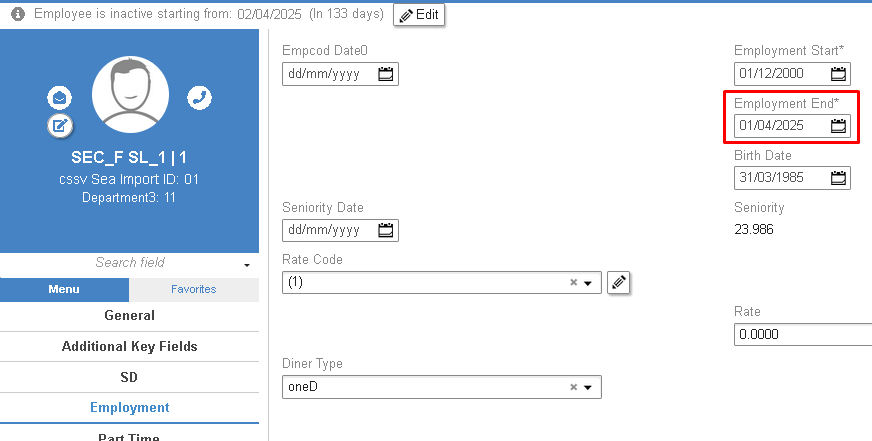

“Employment End” date = 01/04/2025

PP Summary for Future PP - April 2025

Balance for 30/04/2025:

(2) Vacation = 0 Days, No Justification Code 1007

(6) Sickness = 0 Hours, Usage = 1.15 Hours with Justification Code 1007

(16) Recreation = 0 Days, Usage = (-0.50) Days with Justification Code 1007

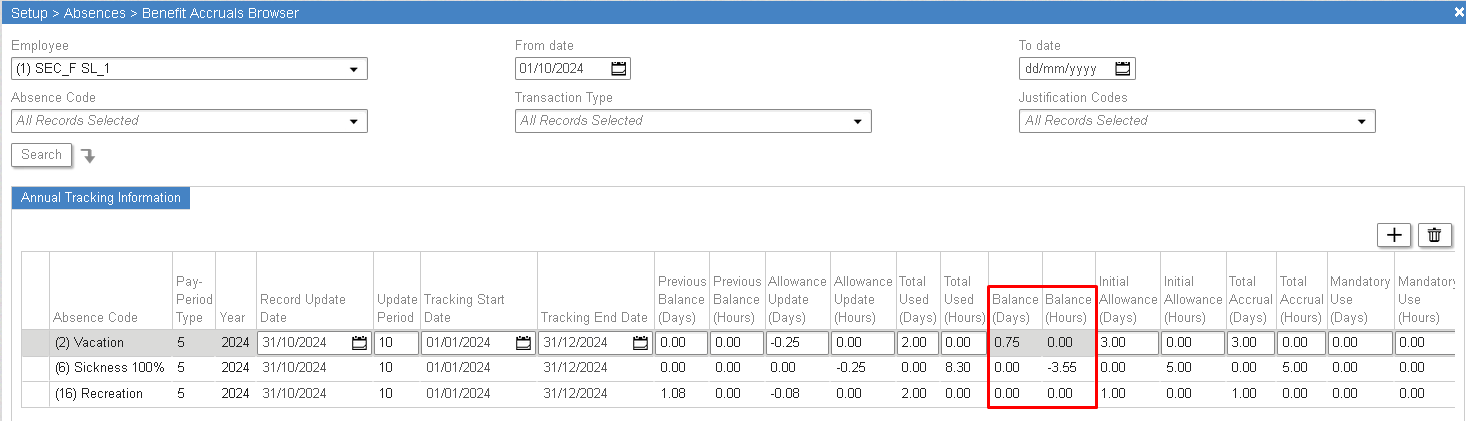

Scenario 3

Current PP

Current PP – November 2024

Balance for 31/10/2024:

(2) Vacation = 0.75 Days

(6) Sickness = (-3.55) Hours

(16) Recreation = 0 Days

Employee 1 – Pay Period Type (5) Calendar

“Employment End” date = 30/11/2024

PP Summary for Current PP - November 2024

Balance for 30/11/2024:

(2) Vacation = 0 Days, Usage = 1.75 Days with Justification Code 1007

(6) Sickness = 0 Hours, Usage = (-3.55) Hours with Justification Code 1007

(16) Recreation = 0 Days, No Justification Code 1007

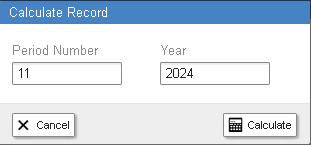

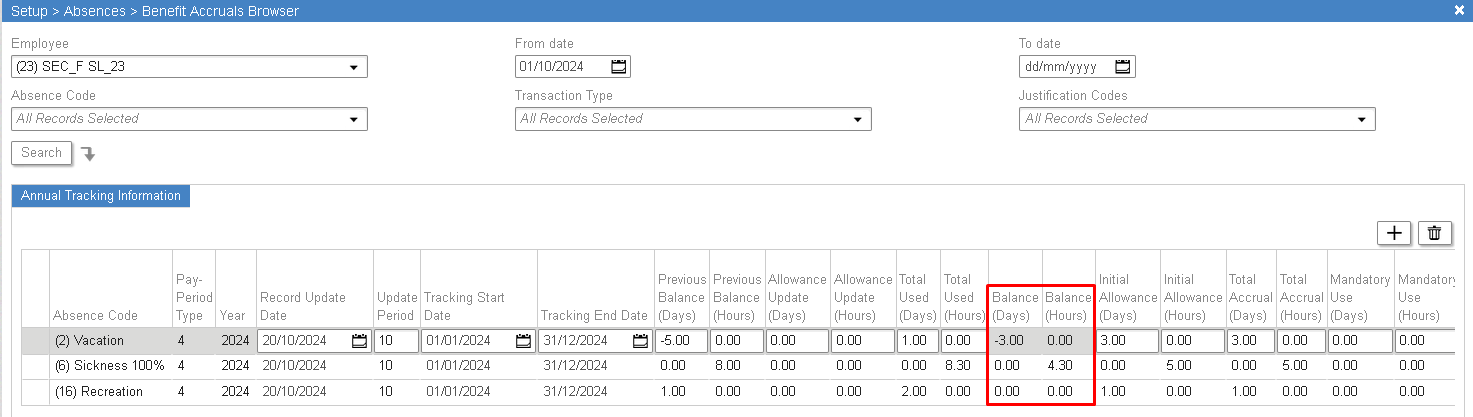

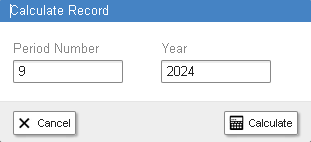

Scenario 4

Previous PP

Current PP – November 2024

Balance for 20/10/2024:

(2) Vacation = (-3) Days

(6) Sickness = 4.30 Hours

(16) Recreation = 0 Days

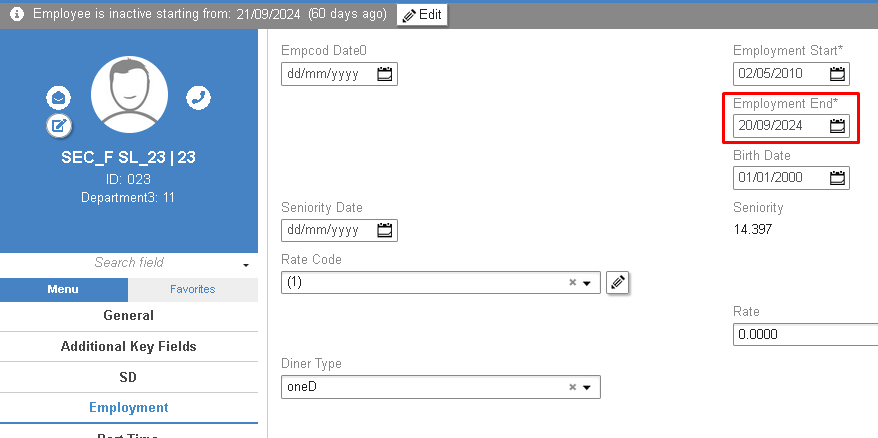

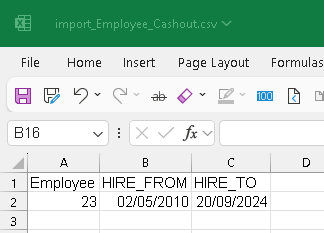

Employee 23 – Pay Period Type (4) Close 20th

“Employment End” date = 20/09/2024

PP Summary for Previous PP - September 2024

Balance for 20/09/2024:

(2) Vacation = 0 Days, Usage = (-2.84) Days with Justification Code 1007

(6) Sickness = 0 Hours, Usage = 11.37 Hours with Justification Code 1007

(16) Recreation = 0 Days, Usage = 0.72 Days with Justification Code 1007

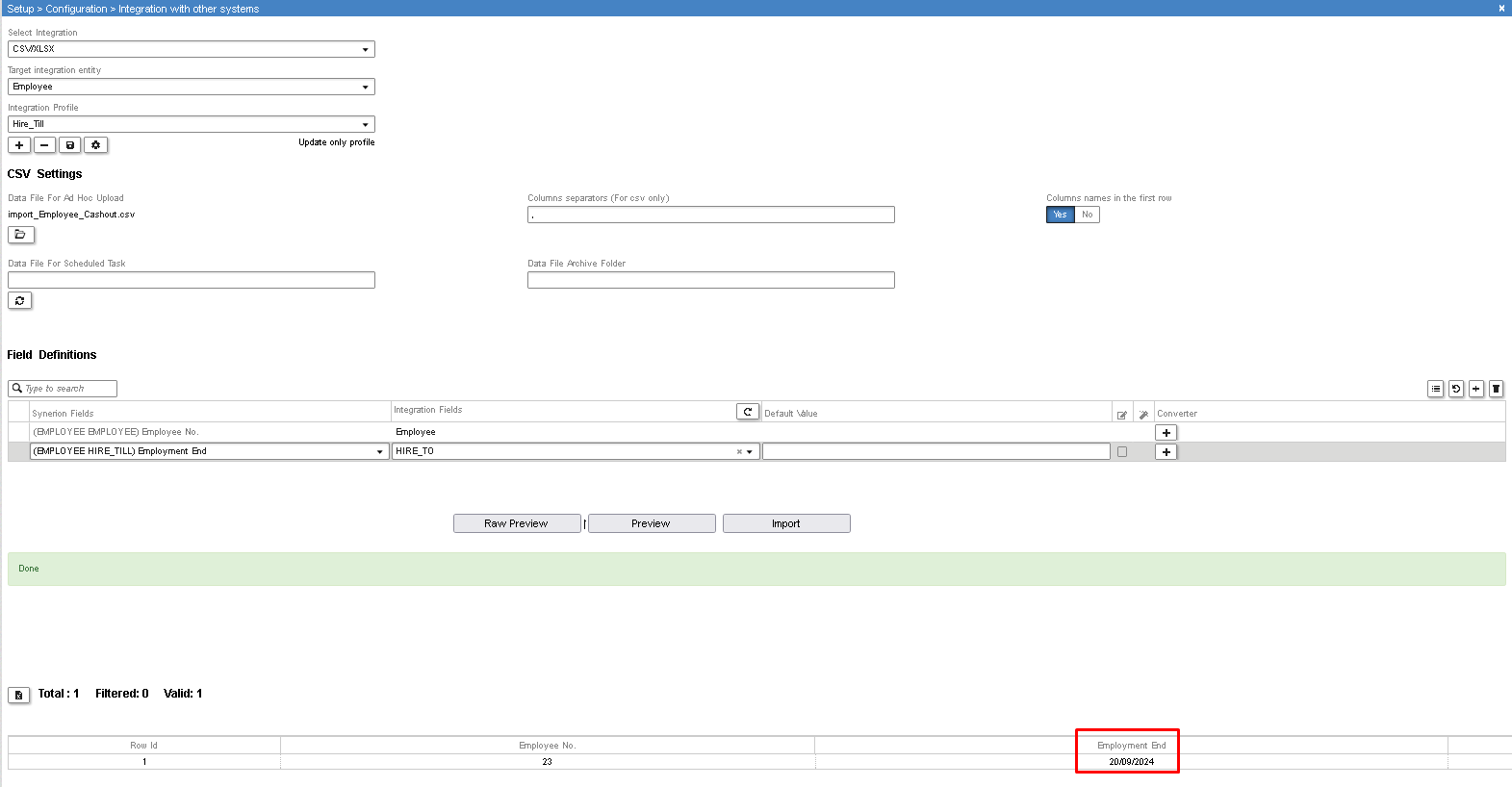

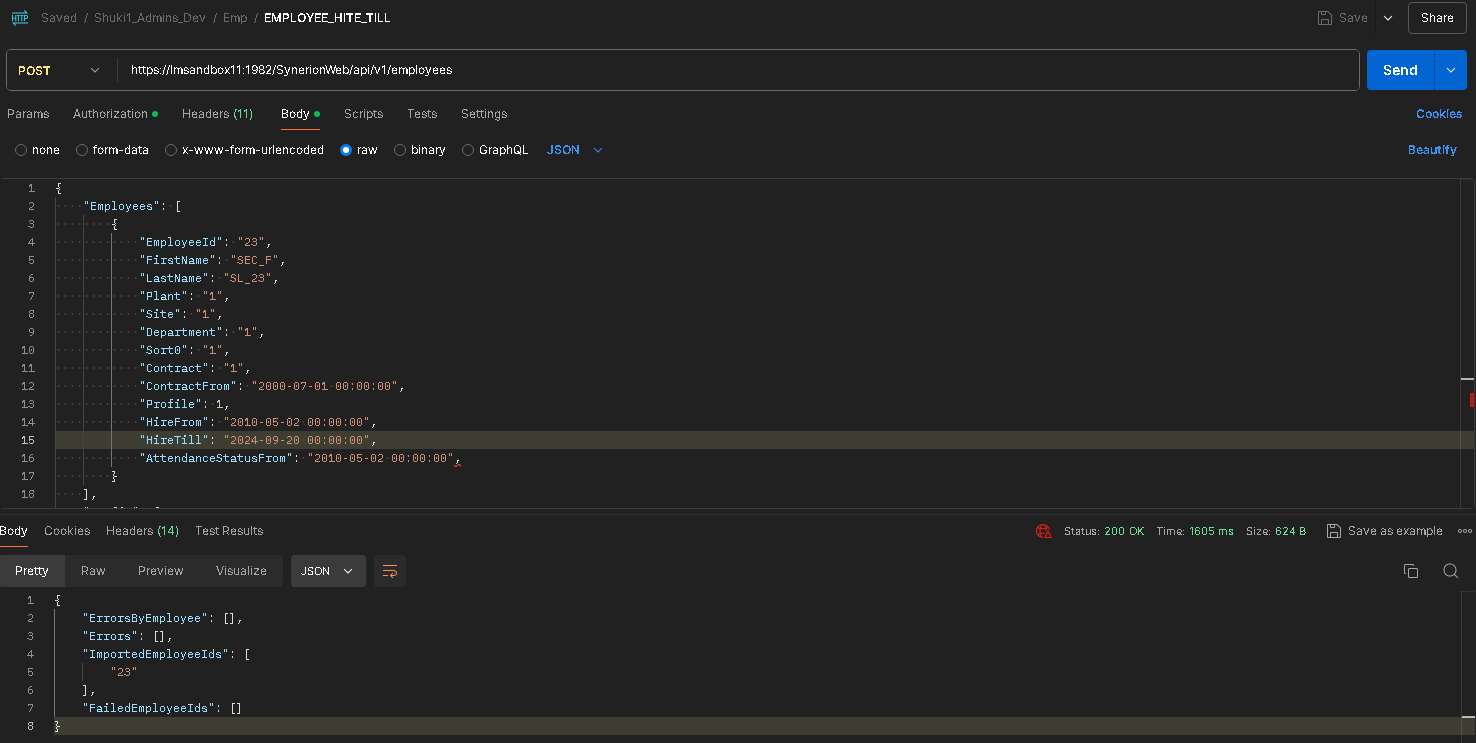

Employee termination

Employee termination can be done by changing “Employment End” date from CoreHR / Master Adapter / API.

Master Adapter

API

Reports

These reports show BuyOut transactions for the selected period:

- Standard TimeCard – RPERIOD5

- TimeCard (Standard+ Audit Trail) – RPER5AT

- Detailed TimeCard – RPERIOD6

- Detailed TimeCard (Extended) – RPER6EXT

- Weekly Summary Report – RP6WEEK

E.g., Report for Period 2024-11 shows BuyOut transactions when they exist in the same Abstrx period.

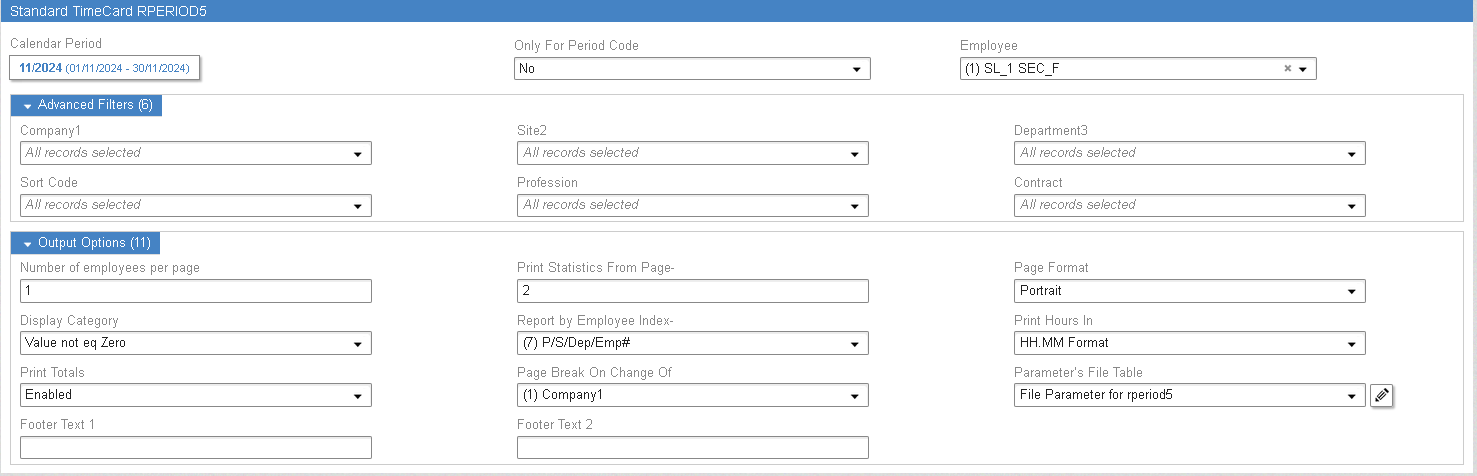

Reports Graphs > Pay-Period Summary Reports > TK – Pay-Period Summary Reports >

Standard TimeCard – RPERIOD5

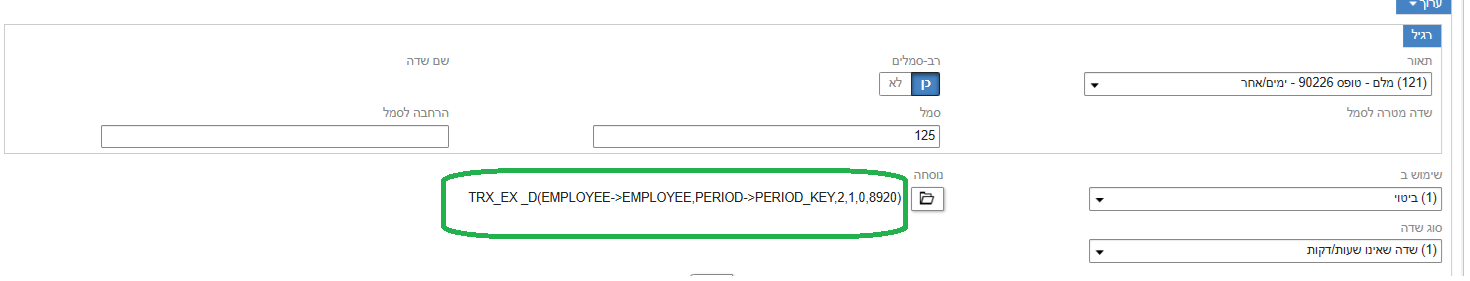

Payroll Implementation

Implementation is needed for exporting to payroll the vacation buyout in TableQ.

In the following screenshot, Justification code 8920 is used for buyout:

When the vacation buyout is negative, the vacation buyout may go to a different pay code in payroll (TableQ).

TRX_EX _D(EMPLOYEE->EMPLOYEE,PERIOD->PERIOD_KEY,2,1,0,1007)

TRX_EX _H(EMPLOYEE->EMPLOYEE,PERIOD->PERIOD_KEY,6,1,0,1007)